- Real estate: The total unconditional exemption from Danish tax on income and capital gains from foreign real estate.

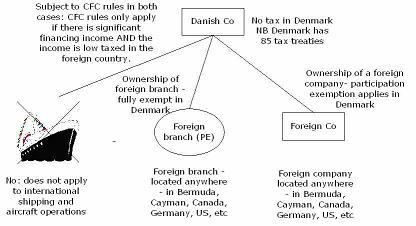

- Foreign branches: The total exemption from Danish taxes on profits of a foreign branch - unless it is a “CFC”.

- Tax consolidation: Modification of the rules relating to tax consolidation; the end of the ability to cherry pick under the international tax consolidation regime ; the introduction of compulsory tax consolidation between Danish companies and Danish units; the reduction of the control test to “more than 50 per cent”.

- Company tax: The reduction of the company tax rate from 30 per cent to 28 per cent

- Foreign currency: The ability to prepare tax returns in a foreign currency.

Foreign Real Estate and Permanent Establishments – Exempt from Tax

The CFC rules do not apply to real estate investments.

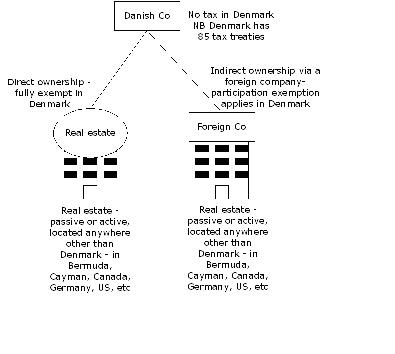

The above describes the rules applicable to investments in foreign companies, i.e. indirect investments. Direct investments in real estate and in the form of a foreign permanent establishment was, however, taxed, with a credit for foreign tax paid. To convert this to exempt dividend income, all that needed to be done was to put the foreign operation into a company , then the participation exemption would apply. That is still the case under the new law. However, the new rules apply similar principles to a direct investments, in foreign real estate and in foreign permanent establishments. As will be seen below, the new rules provide increased opportunities to derive exempt income in Denmark, compared to investing indirectly

The participation exemption rules currently require that the Danish company own 20 per cent of the share capital of the foreign company for at least 12 months in order to obtain the exemption from dividend withholding tax, and three years in order to be able to qualify for the exemption from tax on the gain on sale of shares. The CFC rules also apply.

Under the new rules, the participation exemption law has not changed but the new rules bring direct real estate investments and investments in permanent establishments broadly in line with the participation exemption.

- the gross income from the foreign real estate or permanent establishment and all related expenses are kept out of the Danish tax base.

- any gain on the sale of the real estate or permanent establishment is similarly excluded from the tax base.

The exemption from Danish tax is implemented by way of an amendment to Section 8 of the Company Tax Act, by the addition of a sub-section, sub-section 2. Our unofficial translation of the most pertinent text is as follows:

Section 8. Income and expenses which are attributable to a permanent establishment or to real estate abroad, or in the Faroe Islands or in Greenland, shall not be taken into account in the determination of the taxable income. Income from a permanent establishment and from real estate is income as described in Section 2 & . The first sentence of this sub-section does not apply to international shipping and aircraft operations or to situations where Denmark is given the exclusive right to tax pursuant to a double tax treaty. Notwithstanding the first sentence of this sub-section the company shall be taxable on its positive CFC income where such income would have been covered by Section 32 had the permanent establishment been a foreign company. The principles applicable to the determination of the income of permanent establishments shall be applied in connection with the evaluation of whether CFC income shall be included in the taxable income and in connection with the calculation of the CFC income. Section 32 shall also apply except for sub-section 2, the first sentence of sub-section 7, sub-section 8 and sub-section 13.

Section 32 sets out the Danish CFC rules. This is only relevant to permanent establishment – not to foreign real estate. These only apply if the net income of the foreign branch is significantly of a financial nature and if the tax abroad is significantly lower than the Danish tax that would have applied had it been in Denmark. However, a modification is made in the branch situation – normal permanent establishment rules are applied so that in most cases payments of interest and royalties between the permanent establishment and its Danish head office are ignored in determining whether the foreign branch is a CFC.

Section 2 & specifically refers to the fact that gains on sale of a permanent establishment and of real estate are “income”. Accordingly, a capital gain on the sale of a permanent establishment or of foreign real estate is exempt from Danish tax.

The new rules on real estate have effect for income years commencing on or after 15 December 2004.

Illustration of the real estate exemption

Danish Co exempt from Danish tax on foreign real estate

Danish Co exempt from tax on foreign permanent establishment income

Implication of the Real Estate Exemption Rule: Examples

UK Real Estate

The new Danish real estate rule can be used tax effectively for investment in UK real estate. If a Danish company is the owner of the real estate in the UK and the real estate is not a part of a permanent establishment of the Danish company, there is no tax on the capital gain on the sale of the real estate under UK domestic law. However, the income from the real estate will be taxed in UK. In any event there will be no tax in DenmarkREITs

Argentinean Real Estate

Portuguese REIFs

Tax Haven Real Estate

Conclusion

1 For the participation exemption to apply to dividends received, at least 20 per cent of the subsidiary must be owned – however, under the new exemption even a fractional ownership interest by the Danish company in the property or permanent establishment will entitle the Danish company to an exemption from tax on the proportional share of the income or capital gain.

2 For the participation exemption to apply to capital gains on the sale of shares, the shares must be held for 3 years. No such requirement exists with respect to the sale of real estate or permanent establishment under the new law.

3 The tax compliance is even simpler than in the case of the participation exemption due to the fact that the real estate or permanent establishment transactions are simply kept out of the Danish company’s tax computations.

4 A direct investment, compared to an investment via a foreign company avoids the costs of setting up and administering that foreign company.

In terms of the choice between a direct and an indirect investment, there are a number of other differences. One of these is that the situs country is very likely to tax the gain on sale, whereas this is far less likely where the Danish company holds the real estate or permanent establishment via a subsidiary and sells the shares in that subsidiary.

In principal the Danish company has the choice of making the investment directly or via a subsidiary; in both cases there would not normally be any Danish tax, but the choice must always be made with due care and with appropriate input from properly experienced professional advisers.

Ned Shelton is the Managing Partner of Sheltons, the specialist Danish and international tax consulting firm based in Copenhagen. www.Sheltons-tax.dk N.Shelton@Sheltons-tax.dk